All Categories

Featured

Table of Contents

This is only recommended in the event where the survivor benefit is extremely crucial to the policy proprietor. The added price of insurance policy for the boosted insurance coverage will certainly reduce the money worth, thus not perfect under unlimited banking where money worth determines just how much one can obtain (Self-financing with life insurance). It is very important to note that the availability of dividend options may vary depending on the insurance business and the specific policy

There are wonderful benefits for limitless financial, there are some things that you must take into consideration before getting into limitless financial. There are likewise some disadvantages to limitless banking and it could not be suitable for someone that is searching for budget-friendly term life insurance policy, or if somebody is considering buying life insurance policy exclusively to protect their family in the event of their fatality.

It is essential to comprehend both the advantages and restrictions of this financial strategy prior to making a decision if it's right for you. Complexity: Unlimited financial can be complex, and it is very important to comprehend the details of how a whole life insurance policy plan works and how policy loans are structured. It is very important to appropriately set-up the life insurance policy policy to optimize boundless banking to its complete potential.

Infinite Banking

This can be specifically bothersome for individuals that count on the fatality advantage to attend to their loved ones. Generally, boundless financial can be a helpful economic approach for those that understand the details of just how it functions and are prepared to accept the expenses and limitations connected with this financial investment.

Select the "riches" alternative instead of the "estate" option. A lot of companies have 2 different types of Whole Life plans. Select the one with higher money worths earlier on. Throughout a number of years, you contribute a considerable amount of money to the plan to develop the cash worth.

You're basically offering money to yourself, and you settle the lending with time, frequently with interest. As you pay back the lending, the cash money value of the policy is replenished, permitting you to obtain against it once again in the future. Upon death, the fatality benefit is reduced by any type of superior finances, however any remaining death benefit is paid tax-free to the beneficiaries.

What are the risks of using Infinite Banking Benefits?

Time Horizon Risk: If the insurance holder determines to cancel the plan early, the cash money abandonment values may be significantly less than later years of the policy. It is advisable that when discovering this plan that has a mid to long-term time horizon. Taxation: The insurance policy holder might incur tax consequences on the financings, returns, and survivor benefit settlements got from the plan.

Intricacy: Infinite banking can be intricate, and it is very important to comprehend the details of the plan and the money build-up component prior to making any kind of investment choices. Infinite Financial in Canada is a legit financial technique, not a scam - Borrowing against cash value. Infinite Financial is a principle that was established by Nelson Nash in the United States, and it has since been adapted and applied by financial specialists in Canada and other countries

What makes Whole Life For Infinite Banking different from other wealth strategies?

Policy car loans or withdrawals that do not go beyond the adjusted price basis of the policy are taken into consideration to be tax-free. If plan fundings or withdrawals go beyond the modified expense basis, the excess amount might be subject to taxes. It is very important to keep in mind that the tax benefits of Infinite Banking might go through change based upon modifications to tax legislations and regulations in Canada.

The dangers of Infinite Financial include the possibility for plan financings to reduce the death benefit of the plan and the possibility that the plan might not do as expected. Infinite Financial might not be the best method for everyone. It is very important to thoroughly think about the prices and prospective returns of getting involved in an Infinite Financial program, as well as to thoroughly research and comprehend the involved risks.

Infinite Banking is various from conventional financial in that it allows the policyholder to be their very own resource of financing, instead of counting on traditional banks or lending institutions. The policyholder can access the money value of the policy and utilize it to fund acquisitions or financial investments, without needing to go with a standard lending institution.

Is Borrowing Against Cash Value a better option than saving accounts?

When a lot of people require a lending, they apply for a line of debt via a typical bank and pay that financing back, over time, with passion. For physicians and various other high-income income earners, this is possible to do with infinite financial.

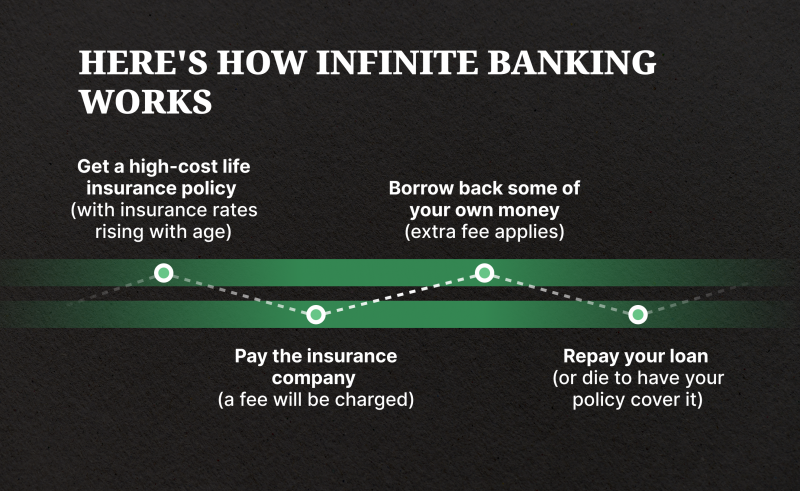

Right here's a monetary advisor's review of unlimited banking and all the advantages and disadvantages included. Limitless banking is an individual banking approach established by R. Nelson Nash. In his book Becoming Your Own Lender, Nash explains how you can utilize a permanent life insurance policy plan that constructs money value and pays rewards hence freeing on your own from having to obtain cash from lending institutions and repay high-interest car loans.

And while not everybody gets on board with the concept, it has tested numerous thousands of individuals to reassess how they bank and exactly how they take financings. In between 2000 and 2008, Nash released six editions of guide. To now, economic advisors contemplate, technique, and dispute the concept of unlimited banking.

What are the benefits of using Infinite Banking For Financial Freedom for personal financing?

The limitless banking concept (or IBC) is a little bit much more challenging than that. The basis of the boundless financial idea starts with long-term life insurance policy. Unlimited banking is not feasible with a term life insurance coverage plan; you have to have a long-term cash money value life insurance policy policy. For the idea to work, you'll need among the following: an entire life insurance policy policy a global life insurance policy policy a variable universal life insurance policy policy an indexed global life insurance policy plan If you pay greater than the required regular monthly costs with permanent life insurance policy, the excess payments gather cash money worth in a cash account.

With a dividend-paying life insurance plan, you can expand your cash worth even quicker. Something that makes whole life insurance policy distinct is gaining a lot more money via rewards. Intend you have an irreversible life insurance coverage plan with a common insurance provider. Because situation, you will be qualified to obtain component of the company's profits just like exactly how shareholders in the business get dividends.

Latest Posts

Tomorrow's Millionaire - Become Your Own Boss

How To Become Your Own Bank Explained‼️ - How To ...

Infinite Banking Strategy: Build Your Personal Bank